Helps you organize expenses into categories, such as advertising, meals, and travel, to simplify tax calculations. The receipts are stored on the cloud and can be retrieved at any time using a mobile app or the desktop version. You won't have to manually add entries.Īllows you to upload and store digital copies or images of expense receipts so your expenses are organized.

#BEST APP FOR MANAGING DAILY EXPENSES UPDATE#

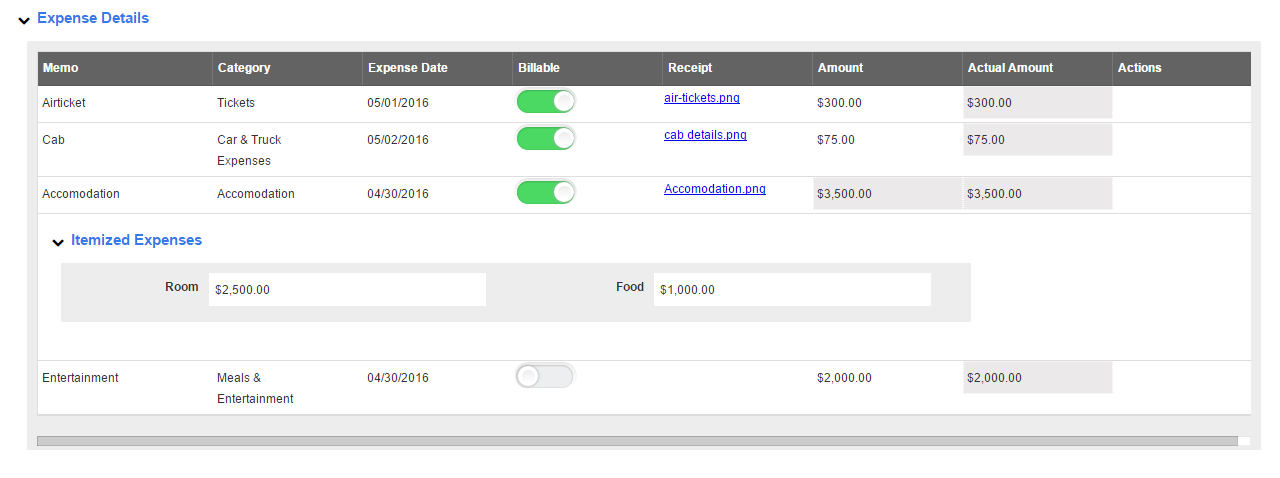

Lets you link your bank account and credit card to automatically note and update each spend in real time. FreshBooks's business-expense tracking capability The software also allows project managers to track time and accurately bill hours so they can prevent unpredictable delays and overruns. Its expense tracking feature helps managers record and track each spend to ensure that no project overruns the budget. FreshBooks: Automate expense organization for easy tax calculationįreshBooks is cloud-based accounting software that offers several features to manage and track invoices, accounts, time, and expenses. The report should help you shortlist the right software for your business.ġ. We created this report to provide you information on the five top-rated accounting apps for tracking business expenses. If the features are able to address your needs, you will be able to reap the software's full benefits. The best way to navigate these issues is by assessing your business needs and matching these to the features of your shortlisted software.

However, the challenge is finding a good enough solution that meets all your business needs and fits your budget.Ī Gartner study on the challenges and approaches to technology investments found that one in two small businesses find “identifying the right technology” to be one of their top three challenges. One way to avoid this situation is by using accounting software to automate most of the processes. These mistakes adversely impact the financial health and future of your business. The chances are higher for erroneous reporting, duplication, and miscalculation of expenses, profits, and loss. Manually recording your business expenses can be a huge challenge.

0 kommentar(er)

0 kommentar(er)